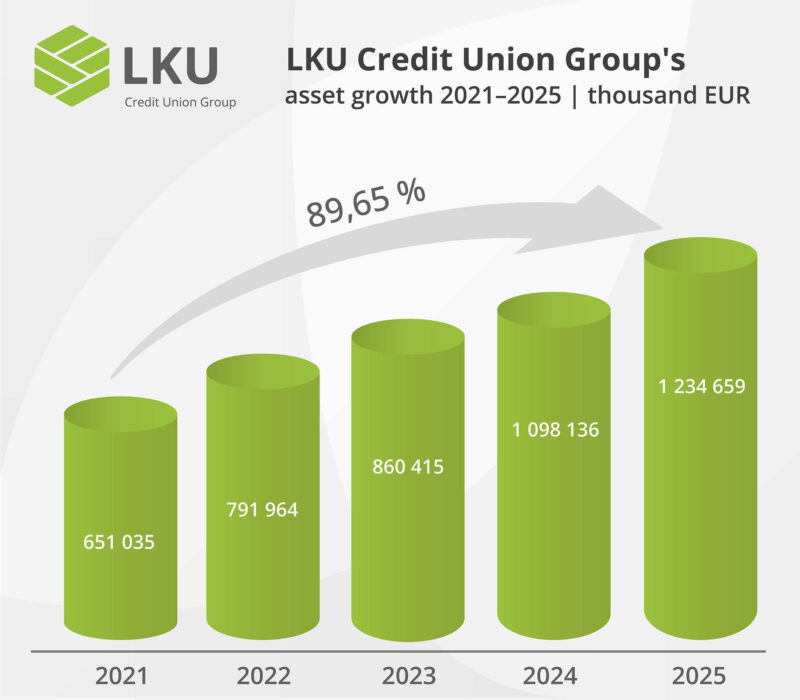

The asset base of the LKU Credit Union Group – which unites 44 credit unions and their supervisory body, the Lithuanian Central Credit Union (LCKU) – reached €1.23 billion at the end of 2025, reflecting annual growth of 12.4%, according to unaudited financial results for the previous year. The LKU Group also maintained stable profitability indicators in the past year while expanding its total loan portfolio by 17%.

According to Mindaugas Vijūnas, Chairman of the Board and CEO of the Lithuanian Central Credit Union (LCKU), the LKU Credit Union Group successfully adapted to the evolving interest rate environment and managed to secure a steady growth trajectory.

„Last year, we financed record-scale projects for the LKU Group, and loan portfolio quality continued to improve. Even against a backdrop of declining EURIBOR, sustained financial resilience and consistent profitability demonstrate the value delivered to our clients by the cooperative banking model,” stated M. Vijūnas.

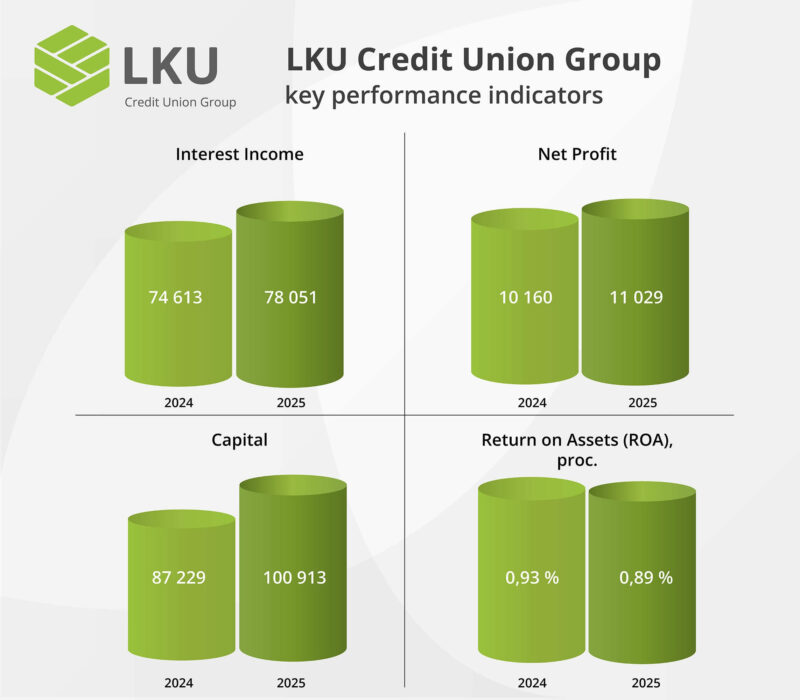

Unaudited data shows that the LKU Group’s net profit for the past year amounted to €11 million – 9% higher than at the end of 2024. Return on assets (ROA) stood at 0.89%, while return on equity (ROE) reached 10.93%, remaining comparable to prior-year levels. The Group’s net interest income totalled €47.9 million.

Active Business Financing

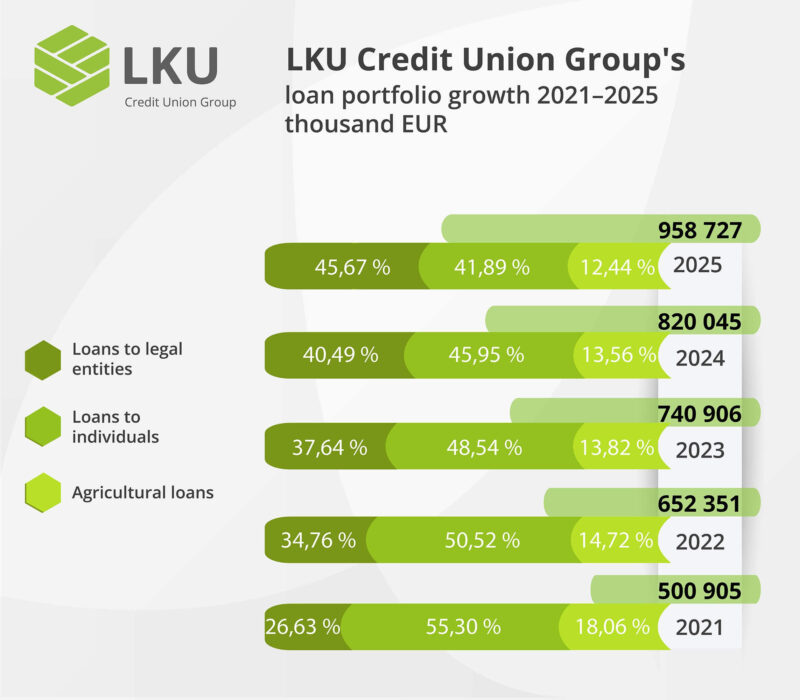

At the close of 2025, the LKU Credit Union Group’s consolidated loan portfolio grew by 17% to €958.7 million. In total, 4,669 new loan agreements were concluded during the year, with a combined value of €322.7 million – 35% more than in 2024.

By segment, business loans saw the strongest growth: their balance sheet value increased by 28.58% over the year to €437.81 million, with new credit issuance during the year reaching €178.3 million. EUR.

Real estate-related financing also expanded rapidly: credit unions within the LKU Group issued €91.2 million in such loans over the year – 53% more than in 2024 – while the segment’s balance sheet value rose 8.7% from the start of the year to €374.4 million.

The agricultural sector also actively utilized financing options, with its loan portfolio growing by 7.7% over the year to €119.3 million. The consumer loan portfolio stood at €27.3 million at the end of 2025 – 10.2% higher than in the same period the previous year.

Rising number of deposit agreements

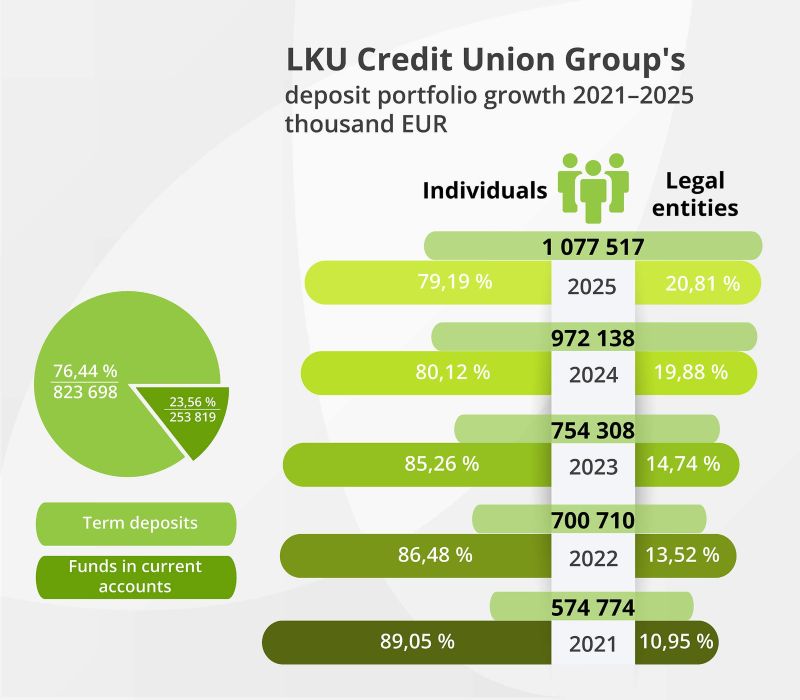

An increasing number of residents and businesses are choosing to save through deposit agreements with the unions. As of 31 December 2025, unaudited data indicates that the LKU Group’s consolidated deposit portfolio – including funds held in current accounts – reached €1.08 billion, a 10.8% year-on-year increase.

Over the past year, 33,500 new term deposit agreements and 2,700 new savings deposit agreements were concluded within the LKU Group.

The Group’s liquidity coverage ratio remains at a high level – 313.1% – and was 15.5 percentage points higher at the end of 2025 than a year earlier, reflecting a strong liquidity position.

Based on unaudited data, the capital adequacy ratio at year-end stood at 15.22%. Upon incorporating this year’s results into reserves, the capital adequacy ratio is expected to reach 16.93%, representing an increase of 0.46 percentage points compared to the previous year. This outcome confirms steady reserve building and consistent strengthening of the Group’s capital base.

According to unaudited data, the asset base of the LCKU – which supervises the LKU Group – grew by 8.8% in 2025, reaching nearly €414 million by year-end.

In total, the supervisory LCKU generated a net profit of €2.93 million – 30.3% more than in 2024. Profitability indicators remained at levels similar to the end of the previous year: ROA stood at 0.71%, ROE at 8.47%, and the cost-to-income ratio at 46.76%.