The Lithuanian Central Credit Union (LCCU), which unites the largest network of credit unions in the country, is launching a public offering of subordinated bonds. The company will offer investors in the Baltic states the opportunity to acquire up to EUR 4 million in 10-year bonds issued under an EUR 8 million bond programme. The bonds will carry an annual interest rate of 8–8.25%, paid semi-annually. The offering will run from 26 November to 12 December. The issue will be listed on NASDAQ’s First North alternative market.

The offering is organised and executed by the investment services company Orion Securities.

According to Mindaugas Vijūnas, Chairman of the Board and Head of Administration of LCCU, the bond issue is a natural step in the growth of a mature and strengthened credit union system. The funds raised will be used to reinforce LCCU’s capital and support the group’s further sustainable development.

“Today, the credit union sector represents a transparent, responsibly regulated financial system that fully meets strict EU standards, with risk management practices on par with the banking sector. At the same time, it has preserved its cooperative model, which ensures additional stability and maintains a close relationship with local communities. We aim to ensure its long-term sustainability while offering investors an opportunity to participate in this financial instrument,” says Vijūnas.

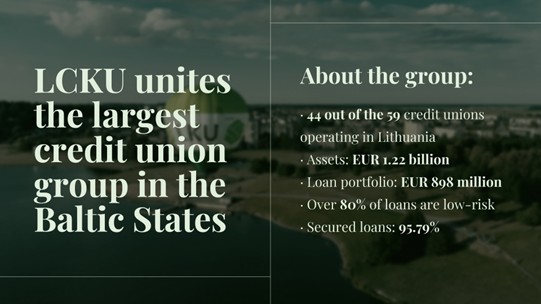

LCCU unites 44 of the 59 credit unions operating in Lithuania, with over 100 customer service locations across the country. The group’s assets amount to EUR 1.22 billion, and its loan portfolio totals EUR 898 million. LCCU plays a key role in organising, coordinating, and overseeing the majority of the credit union sector.

The minimum investment is EUR 1,000. Bonds may be purchased by any investor holding an investment services agreement with banks or brokerage firms operating in the Baltic states.

“Long-term stability and responsibility to our members are core to our operations. We take a conservative approach, and our risk assessment is extremely thorough. This bond issue gives investors a chance to contribute to a financial system that directly supports the well-being of Lithuania’s people and its regions,” adds Vijūnas.

“The bond issue will be offered through an interest auction. When submitting subscription orders, investors will be able to indicate whether they accept an annual coupon of 8% or 8.25%. The final interest rate will be determined based on demand at the different coupon levels,” says Mykantas Urba, Head of Investment Banking at Orion Securities.

More information about this bond issue: https://www.orion.lt/en/lcku-bonds/

More than 80% of the group’s loans are classified as low-risk. In Q3 2025, 99.08% of LCCU’s loan portfolio consisted of secured loans; the figure for the entire LKU Group also remained exceptionally high at 95.79%.

“The raised capital will strengthen LCCU’s balance sheet and support the expansion of the credit union network, enabling it to finance residents and local businesses even more actively. This contributes to the growth of the country’s financial ecosystem and the strengthening of regional economies, as credit unions are often the first financial partners in smaller towns and communities. Investors will become part of a strong and responsibly supervised local financial system,” says Vijūnas.

All LCCU’s operational decisions are made in Lithuania, with a clear focus on the needs of local communities and regions. The same principles guide Europe’s largest cooperative financial institutions – from Germany’s Volksbanken-Raiffeisen network to the Netherlands’ Rabobank – known for their long-term stability, resilience to economic shocks, and importance to local economies.

LCCU’s operations are strictly supervised by the Bank of Lithuania and comply with all EU capital and liquidity requirements applied to banks. At the same time, the LKU credit union group operates an internal risk monitoring and stabilisation system that complements external regulatory oversight. Recent data show that LCCU’s capital adequacy ratio stands at 20.41% (minimum requirement: 14.21%), and its liquidity ratio at 160% (minimum requirement: 50%). The capital of LCCU also includes an investment from the Lithuanian state, whose paid-in contribution currently amounts to EUR 3.979 million. A strong capital base and solid regulatory ratios ensure responsible and stable operations.

The group’s loan portfolio is diversified across sectors and has low concentration: the largest loan granted to a single borrower does not exceed 1% of the total portfolio. The share of overdue loans (more than 60 days) remains low: 1.95% for LCCU and 3.73% for the LCU Group. LCCU continues to actively cooperate with international partners to expand lending opportunities for credit unions: member credit unions can issue loans guaranteed by the European Investment Fund (EIF) under the EaSI guarantee programme. To strengthen the LKU Group’s capital, LCCU has also attracted subordinated loans from the EIF and the Helena fund, totalling EUR 7.4 million. In addition, LCCU has received a EUR 4 million loan from the Council of Europe Development Bank.

Subordinated bonds qualify as Tier 2 capital, and claims of their holders would be satisfied after other creditors. Subject to approval from the Bank of Lithuania, LCCU may redeem the subordinated bonds after five years.

How to invest?

Contact the financial brokerage company or bank in Estonia, Latvia or Lithuania that manages your securities account to submit an investment order (or submit via the self-service platform of the relevant bank).

If you do not have an investment services agreement concluded with a financial intermediary, send us an email to: [email protected]

Investor Presentation

The online presentation of the bond issue (in English) here.

Orion Securities recommends consulting with your financial advisor and evaluating all the risks associated with the financial instrument and/or other circumstances that are significant to you before making an investment decision.